SALARY PACKAGING EXPLAINED

What is RemServ Salary Packaging?

Salary packaging is an ATO-approved employee benefit that could afford you the freedom of making pre-tax payments for selected eligible benefits. However, it can seem quite complicated in the beginning.

Let’s tackle the pre-tax payment scenario first up. Ordinarily, you get paid in return for work, but before this happens, your employer deducts income tax (PAYG). The remaining balance is then deposited into your bank account. Then you pay for all your day to day expenses, and, if you’re lucky, you put a little away for a rainy, or a sunny day.

Salary packaging flips this around: your employer still pays you the same salary, but you could pay for selected expenses before the tax is taken out, rather than after. This could reduce your taxable income and give you more money to spend on the things you want.

SALARY PACKAGING

What are the benefits of salary packaging through RemServ?

Make payments for selected expenses before tax is taken out, which could lower your taxable income.

From day-to-day expenses to repaying your home or car, there’s no shortage of benefits that, depending on your role and your employer, you could package.

We’ve been one of the country's leading employee benefits providers for more than two decades, helping thousands of customers utilise workplace benefits.

Salary packaging can be daunting, but we pride ourselves on making it clear and understandable for you, so you can enjoy the benefits.

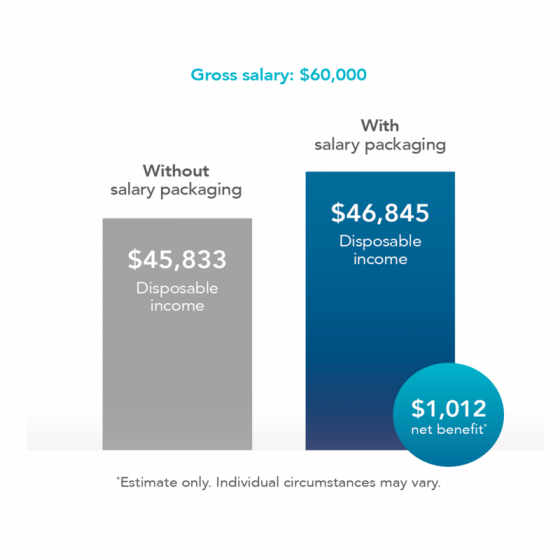

How much could salary packaging save me?

A quick salary packaging example

Karen earns $60,000 per year, and her employer allows her to salary package superannuation contributions. By packaging $3,000 in superannuation contributions annually, she could reduce her taxable income by $891 (Please note the amount Karen can salary package depends on her employer’s salary packaging policy. Contact us to discuss the amount you may be able to salary package given your individual circumstances.)

Frequently asked questions

What is an FBT exemption cap?

Depending on your place of work and your role, you could salary package certain items under the Fringe Benefits Tax (FBT) exemption cap.

The FBT exemption cap limits the amount you can salary package within a FBT year (1 April to 31 March), without incurring FBT.

The cap applies to the combination of salary packaging benefits and non-salary packaging benefits (the latter being any fringe benefit provided by the employer outside of the salary packaging arrangements). However, any non-salary packaging benefits will be applied to the FBT exemption cap first.

Once you reach the FBT exemption cap, all future benefits will have FBT applied. For Queensland Government employees, the cost of any FBT will be your responsibility, including any liability that may be incurred as a result of salary packaging. To find out if you are eligible for the FBT exemption cap please review your employee information booklet, which can be found here.

Want to find out more about salary packaging the RemServ way?

Whether you’re ready to get started or need more information, we’re here to help.