What is a HECS-HELP debt?

It’s a higher education loan payment that works a bit like a loan, but instead of the funds coming from a bank, the government makes a payment to your university on your behalf, saving you from potentially big upfront costs. These loans don’t incur interest, and they don’t have an end date. Once you start working and earn over the income threshold of $67,000*, payments will commence via your payroll.

The amount payable is based on a certain percentage of your income; the higher you earn, the higher the repayment rate. For more information you can visit the ATO website here.

*FY2025-26 figure – thresholds change annually

You can still salary package and have a HECS-HELP debt.

Salary packaging could be an effective way to pay off your HECS-HELP debt. With a RemServ salary packaging account, you could put more money in your pocket each year and pay off your HECS-HELP sooner.

How it works

To make the most of your salary packaging and meet your tax obligations, all you need to do is ask your payroll department to deduct additional HECS-HELP repayments.

RemServ can help you work out how much with our HECS-HELP calculator.

Follow the steps in our online calculator here.

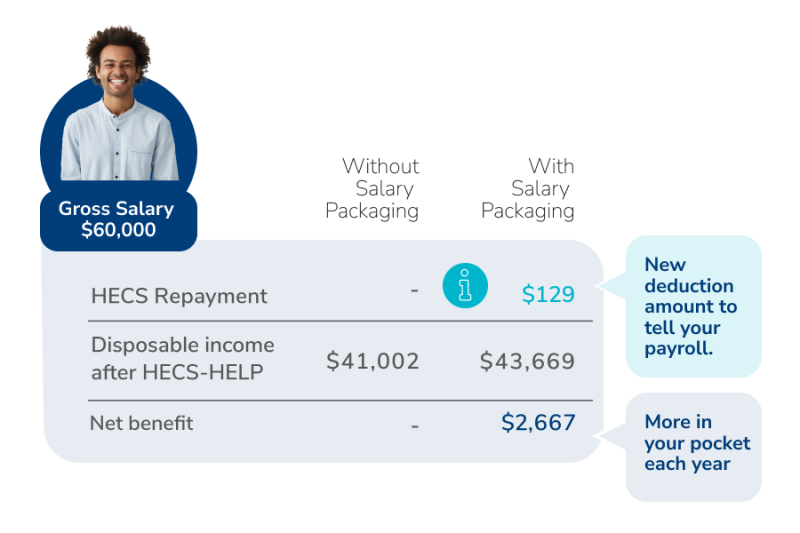

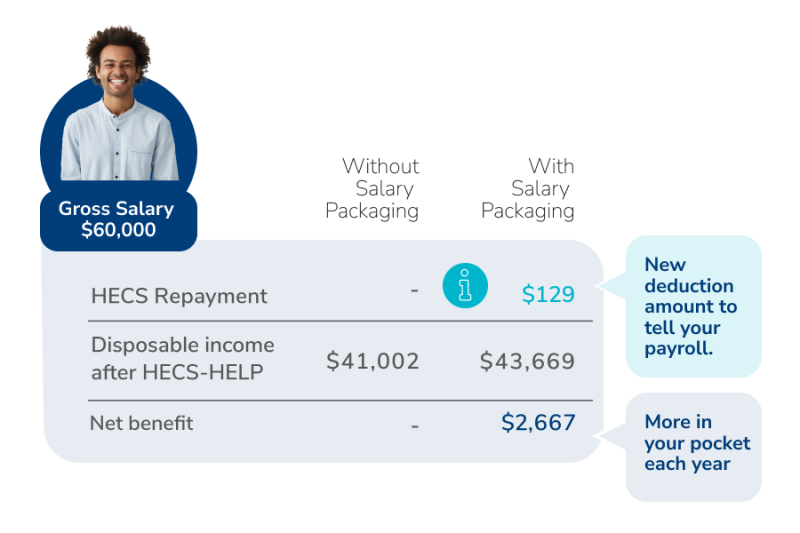

Let’s say you’re a health worker with a HECS-HELP debt earning $60,000. By packaging your full living expenses benefit of $9,010, you could be $2,667 better off each year!*

While your HECS-HELP repayments increase as they are calculated on this adjusted income, you could still increase your disposable income each year through reduced tax.

*Estimate Only: Individual circumstances may vary

How will my HELP/HECS debt impact my salary packaging?

*Salary Packaging: The estimated potential tax benefit is based on an eligible employee with an annual salary of $60,000, salary packaging the full $9,010 per annum limit and claiming $2,650 in venue hire and meal entertainment expenses. PAYG tax rates effective 1 July 2024 have been used. HELP repayments are based on 2025-2026 HELP repayment thresholds and rates. An average salary packaging administration fee has been used. The actual administration fee that applies to you may vary depending on your employer. Estimated annual benefit based on the assumption that an employee does not have any accumulated Financial Supplement debt. Your disposable income will vary based on your income and personal circumstances. Compulsory HELP repayments commence once your adjusted taxable income is above $67,000.

Important information: Salary packaging is only available to eligible employees of the Queensland Government as per the Standing Offer Arrangement QPG0065-21. The implications of salary packaging for you (including tax savings and impacts on benefits, surcharges, levies and/or other entitlements) will depend on your individual circumstances. The information in this publication has been prepared by RemServ for general information purposes only, without taking into consideration any individual circumstances. RemServ and the Queensland Government recommend that before acting on any information or entering into a salary packaging arrangement and/or a participating agreement with your employer, you should consider your objectives, financial situation and needs, and, take the appropriate legal, financial or other professional advice based upon your own particular circumstances. You should also read the Salary Packaging Participation Agreement and the relevant Queensland Government Salary Packaging Information Booklets and Fact Forms available via the Queensland Government Arrangements Directory. The Queensland Government strongly recommends that you obtain independent financial advice prior to entering into, or changing the terms of, a salary packaging arrangement.

Remuneration Services (Qld) Pty Ltd | ABN 46 093 173 089