We all want a little more. A little more for now, a little more for later. While employer-paid superannuation helps you save for your retirement, you could further set yourself up for the future with the help of RemServ, one of Queensland Government’s trusted salary packaging providers with more than 20 years’ experience.

Best of all, you could save on tax – it’s a win-win!

How salary packaging superannuation works

As a Queensland Government employee, there are now two voluntary superannuation contributions you can make: Default (which used to be the compulsory contribution); and Additional.

While you no longer have to contribute a compulsory portion of your salary to superannuation, you could still benefit from salary packaging super payments – up to an annual cap of $30,000.

When salary packaging super, your contributions are taxed at a ‘concessional’ rate of 15 per cent, which is lower than the marginal tax rate for most people. And because you’re putting your before-tax income into your super account, you could enjoy a lower annual taxable income.

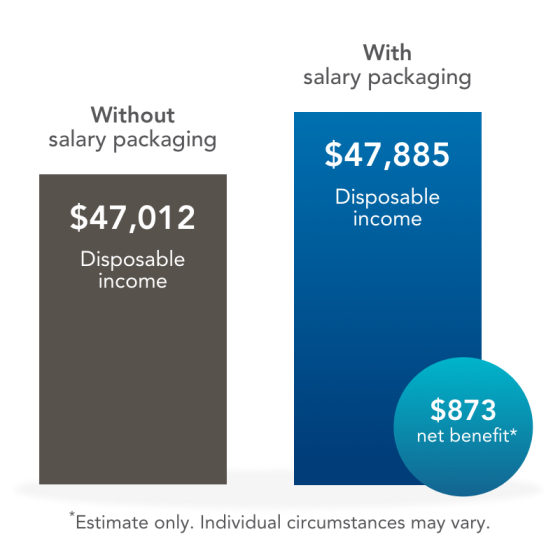

How much could you save?

Here’s an example. Sam, a school teacher, makes $60,000 per year. By salary packaging $3,000 in voluntary superannuation, he could enjoy a net benefit of $873 (or $33.57 per fortnight).

It’s never too early or late to invest in your future.

Apply online in 5 steps!

1. Getting started: visit our website, create a login and verify your email.

2. About you: complete the fields about you, such as your name and date of birth.

3. Your employment: add in your pay details, which can be found on your pay slip.

4. Superannuation: click to add your default super and/or additional contributions.

5. Application summary: review and submit.

Contact us

Sign up to salary packaging, your way.

Salary Packaging: Additional superannuation contributions from pre-tax salary are subject to 15% contributions tax. The taxation of additional superannuation contributions via salary packaging may differ from the taxation of additional superannuation contributions from post-tax salary. Additional superannuation contributions will be reported on an employee’s annual payment summary and will be used to assess an employee’s eligibility for a number of government benefits, or liability for certain payments. Caps for concessional superannuation contributions apply – please refer to www.ato.gov.au for up to date information.

Important Information: Salary packaging is only available to eligible employees of the Queensland Government as per the Standing Offer Arrangement QGP0065-21. The implications of salary packaging for you (including tax savings and impacts on benefits, surcharges, levies and/or other entitlements) will depend on your individual circumstances. The information in this publication has been prepared by RemServ for general information purposes only, without taking into consideration any individual circumstances. RemServ and the Queensland Government recommend that before acting on any information or entering into a salary packaging arrangement and/or a participating agreement with your employer, you should consider your objectives, financial situation and needs, and, take the appropriate legal, financial or other professional advice based upon your own particular circumstances. You should also read the Salary Packaging Participation Agreement and the relevant Queensland Government Salary Packaging Information Booklets and Fact Forms available via the Queensland Government Arrangements Directory. The Queensland Government strongly recommends that you obtain independent financial advice prior to entering into, or changing the terms of, a salary packaging arrangement.

This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, along with credit assessment criteria for lease and loan products. The availability of benefits is subject to your employer’s approval. RemServ may receive commissions in connection with its services.

Remuneration Services (Qld) Pty Ltd | ABN 46 093 173 089